I don’t know what to say right now. I know I have been here before. I am embarrassed. My confidence is shot. I feel sick. Should this be the end to my Forex journey?

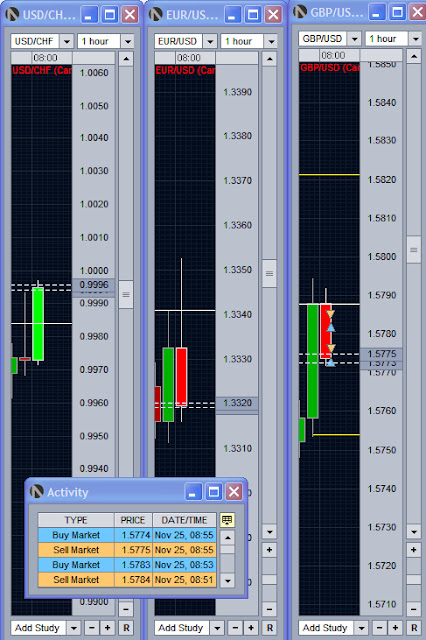

What can I say apart from that I have truly fucked up today! All that I thought had been put behind me came back and hit me hard! I lost over £800 today! Every rule I can think of was broken. I decided to sit down for an afternoon session and it all went wrong. A stop loss took me out of a trade, stop losses were moved, pip values changed, being hopeful with trades, entering too many trades – and everything else under the sun that should not have been done, was done!

I am right back where I started. I have now effectively lost almost £4k since originally investing £20k in September, an average of £2k per month, not bad huh? What am I going to do? My ultimatum from last week means this is it for me......however everything in me is saying I can still do this. But at what cost – the rest of my capital? The bad habits that I have got into are ingrained in me now – I fear that the steps I have to take to get back on the straight and narrow are so far ahead of me, I might never reach them. Am I simply deluding myself into thinking everything will be ok?

Sid at Forex Training Works warned us all that once you start down the wrong path, turning back becomes very difficult. He was right. The stories about others who had strayed now apply to me. I am one of the statistics. And what worries me, is that I don’t recall hearing any stories about those who strayed and came back........

If I am going to continue with my Forex dream, I need a plan and have to stick to the plan, so I am going to put something down now;

- I’ve just reduced my pip value to 25p per pip.

- This pip value will not be increased until one full week of good trading is achieved. If this is achieved weekly, I will double the value weekly. If I don’t follow the rules for even one day in a given week, the next move will be back to demo trading. I have to right?

- GOWID must be exercised at all times.

- I will improve my trade entry points. This will involve me being a lot more patient than I have and ensuring that there is strong correlation between the currencies before trading. Not doing this is probably the biggest contributing factor for why I have been going wrong.

- No more than 3 trades will be entered into per day. At least until I have systematically worked my way up to the £40 per pip level – this now being the appropriate pip value based on the capital I have left. Executing numerous trades in one day or session is another reason for my fuck ups – Sid used to call it revenge trading.

- The maximum duration of each session will not be more than 2 hours.

I think that’s it.